Stamp Duty Calculator

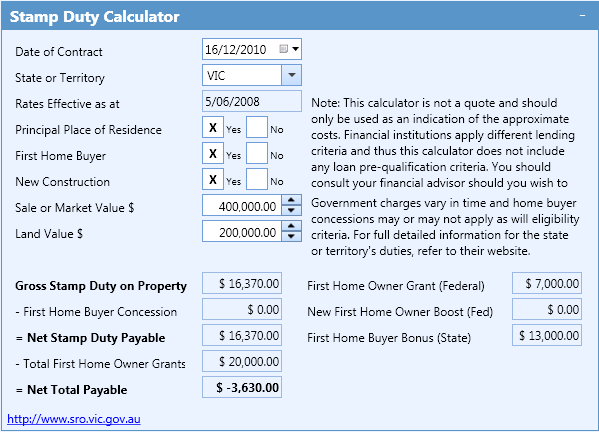

This calculator will determine the stamp duty payable on sale of property for all Australian states, taking into consideration the relevant State first home buyer concessions/grants/bonuses and the Federal first home owner boost.

Enter the date of contract, State and select whether:

- The property is a principal place of residence;

- The buyer is a first home buyer;

- The property is a new construction.

Also enter the sale or market value of the property and the land value.

Based on this input, the Gross Stamp Duty on Property will calculate as well as any First Home Buyer Concession and a total of all applicable First Home Owner Grants, resulting in a Net Total Payable.

Example 1 : Stamp Duty Data Entry

For more detailed information on the different State stamp duty rates and calculation methods, the relevant State’s information is displayed under “Rates” including a link to the appropriate website.

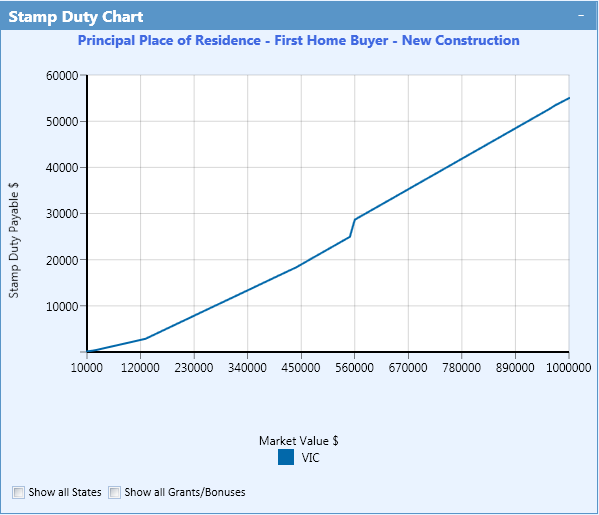

Stamp Duty Chart

In addition a chart graphs the stamp duty payable for a range of market values. This graph can be changed to show all States and all grants/bonuses.

Example 3 : Stamp Duty Chart

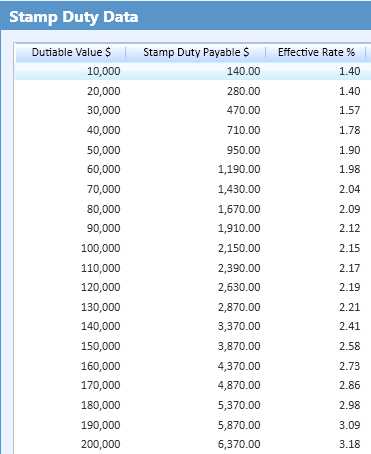

Stamp Duty Data

A data table displays the relevant figures and effective rate %.

Example 4 : Stamp Duty Data

ABN 71107714241 ACN 107714241

To the fullest extent permitted by law, PLANSOFT makes no representations or warranties about the accuracy, completeness, security or timeliness of the content, information or services provided by the website and disclaims all warranties, either express or implied, statutory or otherwise, including but not limited to the implied warranties of merchantability, non-infringement of third parties' rights, and fitness for a particular purpose.